In this article we will see in detail what the new variable inflation model on the WAX blockchain is and how it works. This is not a banal concept, and to understand it we will first have to clarify well what is meant by the word inflation on a blockchain where the max supply is variable.

PLEASE NOTE: This guide was written trying to simplify complex concepts as much as possible; although I have worked hard to do so, some information may not be entirely correct. I apologize in advance!

CONTENTS

This article is divided into four parts:

- the first part will analyze the concepts of “circulating supply”, “total supply” and “max supply” of a token, together with those of inflation and deflation

- the second part explains the two methods that allow you to carry out transactions on the WAX blockchain: PowerUp and Staking

- the third part will talk in detail about the WAX variable inflation model

- the fourth part explains how the CPU is divided between those who use the PowerUp and those who use Staking, and how this allocation will change in the future

Part one: key concepts

Circulating supply, total supply and max supply; inflation and deflation

Before we dive into the subject and talk about inflation and deflation, it is important to understand the meaning of three concepts: circulating supply, total supply and max supply. To understand what they are, we will look at how Bitcoin, Ethereum, Solana and WAX behave.

Circulating supply

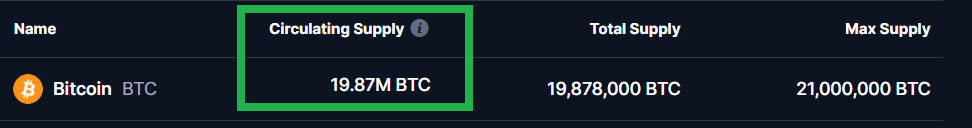

Circulating supply is simply the sum of all the coins currently in circulation. If I could buy all the Bitcoins in circulation today, assuming that all the holders are willing to sell me their BTC, I would be able to have 19.87 million bitcoins, not one more.

Max supply

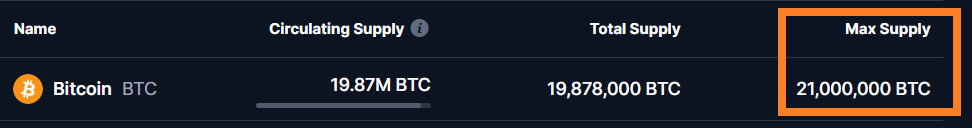

You may have heard that “there will be a maximum of 21 million Bitcoins”: this is absolutely true, as 3.125 new Bitcoins are currently created every 10 minutes (every block). The policy of creating Bitcoins is fixed and will never be changed, and the creation of new Bitcoins will end when the number of 21 million is reached. This is exactly what max supply means!

Total supply

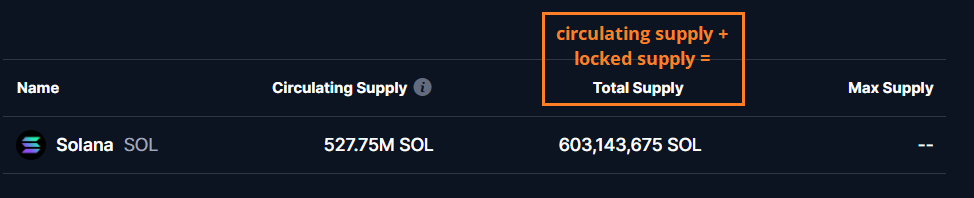

Finally, there is a third concept, the total supply. The concept is often confused with the max supply, but it is different: it indicates the total of the coins existing now. So is it the same thing as the circulating supply? No! The circulating supply indicates the coins existing now that can be moved, while the total supply includes those that cannot be moved. There are some blockchains, such as Solana, that have sold coins to investors with a particular constraint: they cannot be used until a certain day (or several days), after which they will be “unlocked”. This phenomenon is known as vesting and often has negative outcomes, since on the days of the unlocking many investors sell en masse part (or all) of the coins they had bought, especially if they had bought them at a lower price than the current one. These coins already exist, so they enter the total supply, but they cannot be moved yet, so they do not enter the circulating supply!

There are 603 million SOL already created but only 527 million SOL in circulation: this means that there are about 66 million SOL already in the wallets of some investors that are not yet unlocked!

We are now ready to compare BTC, ETH, SOL and WAX. Here are the data:

As you can see from the statistics:

- BTC: There are currently 19,878,000 Bitcoins (total supply); they are all circulating (circulating supply), so there is no BTC locked up, and the maximum number of BTC that will ever be reached is 21,000,000 (max supply)

- ETH: There are currently 120,721,097 Ether, all circulating, but there is no fixed number that will ever be reached (max supply)

NOTE: this does not mean that there will be more ETH every day, because Ethereum has a mechanism that can increase or decrease the total supply based on the chain usage

- Solana: There are currently 603 million, only 527 million in circulation; there is no fixed number that will be reached

- WAX: There are currently 4,405 million WAXP tokens, they are all circulating; there is no fixed number that will be reached

What interests us is that, as far as WAX is concerned:

- the WAXP total supply and the WAXP circulating supply are equal, therefore there are no WAXP locked in investors’ portfolios that will be released on the market in the future

- there is no WAXP max supply

Inflation

The term “inflation” has various meanings, and often there is a risk of misunderstanding. In this article the term of annual inflation will always have this meaning

ANNUAL INFLATION: the percentage increase in total supply over the past year

The term “inflation”, therefore, will not have any meaning in this article related to the dollar value of WAXP: it is a term that we will use only to describe the variation of the currently total/circulating WAXP supply (they are the same, as seen before) compared to the previous year.

Let’s take an example: if last year the total supply of WAXP had been 4000 million while today it had increased to 4080 million we would have had an inflation of 2%

Deflation

Now comes the best part: as you know, the WAX blockchain has developed a new system, called “variable inflation model”, which through some mechanisms that we will see in the next paragraph can allow the total/circulating supply not only not to increase, but even to decrease! This concept will be described with the term deflation

ANNUAL DEFLATION: the percentage decrease in total supply that occurred in the last year

Let’s take another example: if last year the total supply of WAXP had been 4000 million while today it had decreased to 3960 million we would have had a deflation of 1%

Part two: PowerUp and Staking

The two ways to do a transaction on WAX

As you probably already know, if you want to make any transaction on the WAX blockchain you will need to use a resource usually called “CPU”. More complex transactions, such as sending 50 NFTs from one account to another, will use more CPU while simpler transactions, such as sending some WAXP from one account to another, will use less CPU.

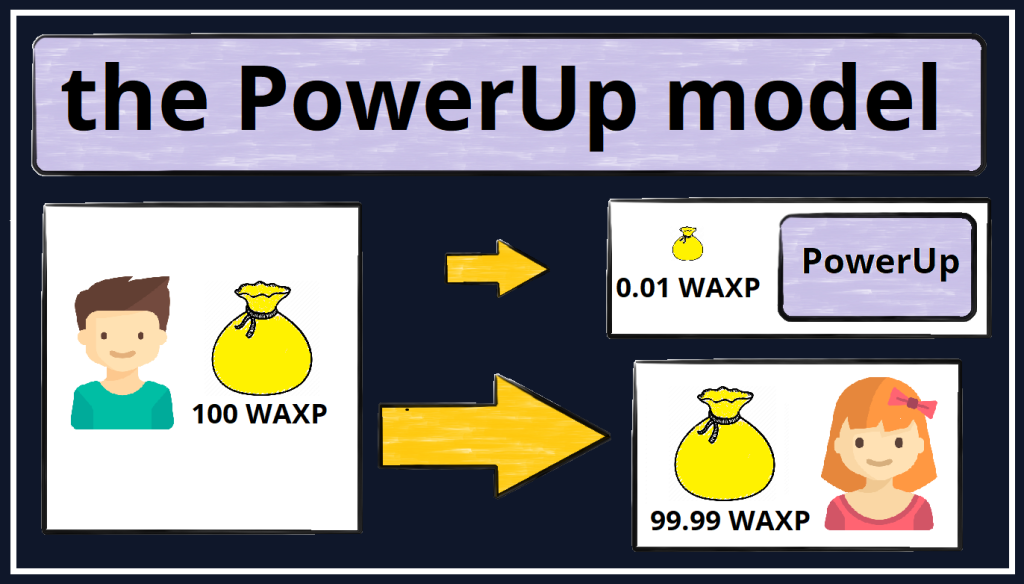

There are two ways to get this resource, the CPU: the first way is called “PowerUp”. Basically you pay a small fee in WAXP (usually a few cents of WAXP) and you get the CPU you need. This is basically what happens on most blockchains: pay to transact.

For example, if Karl had 100 WAXP and wanted to send it to Lisa he could pay a few cents of WAXP to use the PowerUp; Lisa would get the difference

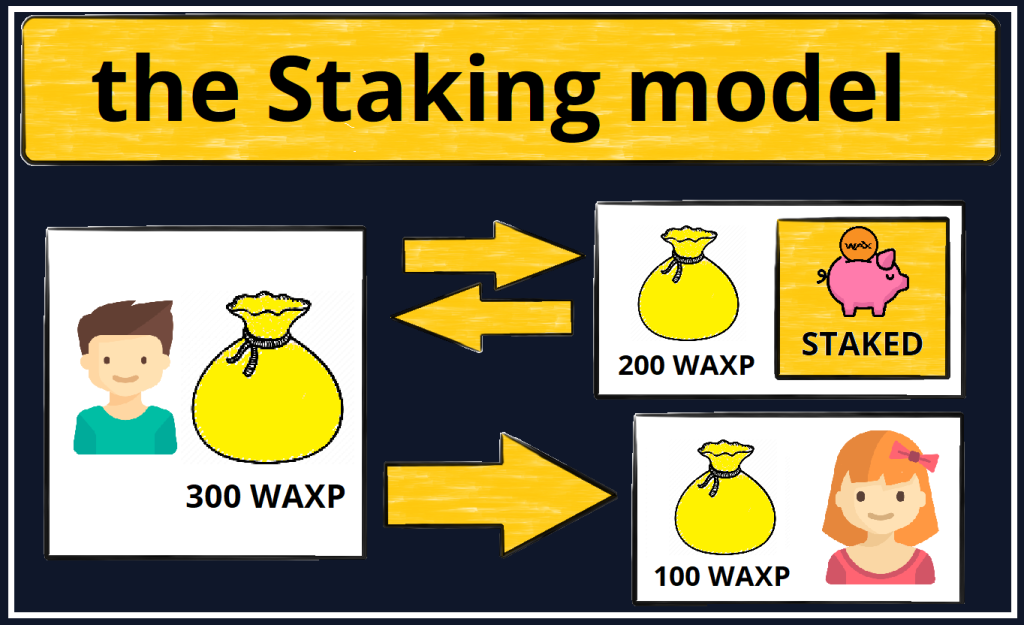

The second method, however, works in a very different way. You can stake (block) a certain amount of your WAXP to get some CPU for free. Your staked WAXP is frozen and can’t be used in any way: however you can always get it back after 72 hours have passed (this process is called “unstake”). The CPU obtained in this way automatically “regenerates” 24 hours after being used, so you can make endless transactions for free (not endless every day, of course)!

For example, if Karl has 300 WAXP and wants to send 100 WAXP to Lisa he can stake the remaining 200 WAXP: by doing so he will receive the necessary CPU and the transaction will be free

It is clear that the two methods are profoundly different: the PowerUp can be used by anyone, and is the simplest choice for new users as no particular knowledge is needed. Staking, on the other hand, is usually used by more expert users, both because it requires more skills (even if it is not difficult to stake your WAXP) and because if you want to do a lot of transactions you should stake a lot of WAXP

NOTE: Staking your WAXP also has another advantage: it will allow you to receive an APR of around 10%. This means that if you stake 100 WAXP for a year you will receive 10 WAXP; if you stake them for a month, about 1 WAXP. There are no minimum or maximum limits to the stake time and you can claim your staking rewards every 24 hours!

Part three: the WAX variable inflation model

WAXP out of circulation, WAXP in

Every year a certain amount of WAXP tokens go out of circulation, because it is used to buy PowerUps – which is essentially the method of operation of all current blockchains.

Other WAXP tokens are instead put into circulation, mainly for three reasons:

- to guarantee staking rewards to WAXP stakers

- to give a reward to guilds (block producers) to validate all transactions on WAX (both active guilds and “reserve” ones)

- to give a reward through WAX Labs to those who contribute with programs, databases, DEXs and anything else to the WAX ecosystem

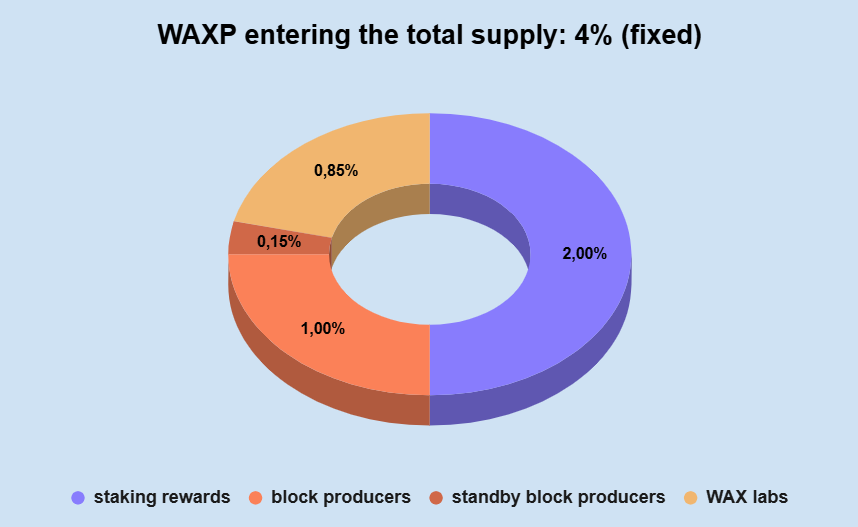

The amount of WAXP that is put into circulation each year is this fixed amount (the percentages refer to all the existing WAXP):

- 2% for staking and voting rewards

- 1% for block Producer Rewards

- 0.15% for standby Block Producer Rewards

- 0.85% for WAX Labs

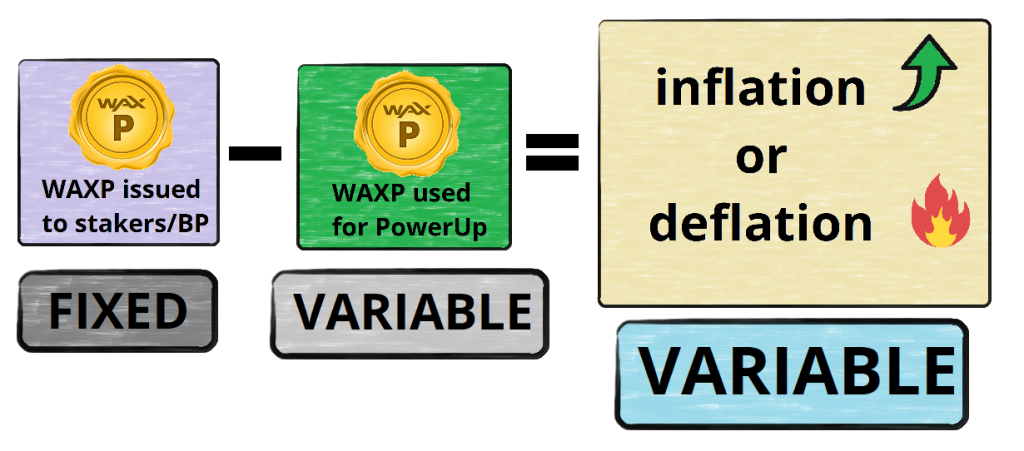

In total, therefore, 4% of the circulating WAXP are put into circulation each year. Does this mean that 4% of the existing WAXP tokens are created from scratch each year, thus giving rise to an inflation of 4%? No! In fact, as we said, there were also some WAXP removed from circulation during the year, i.e. all the fees collected with the power-ups.

New WAXP are created only when those collected with the power-up are not enough to cover those that need to be distributed as rewards!

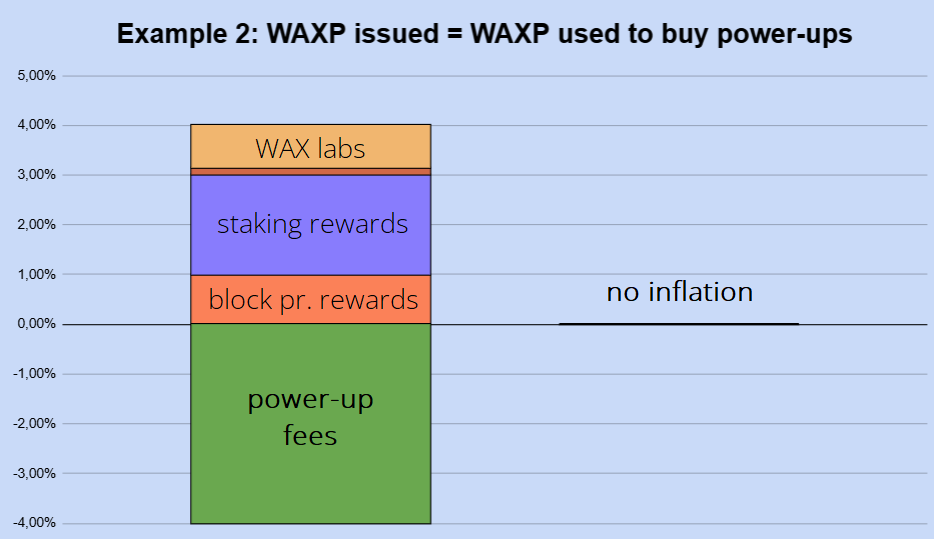

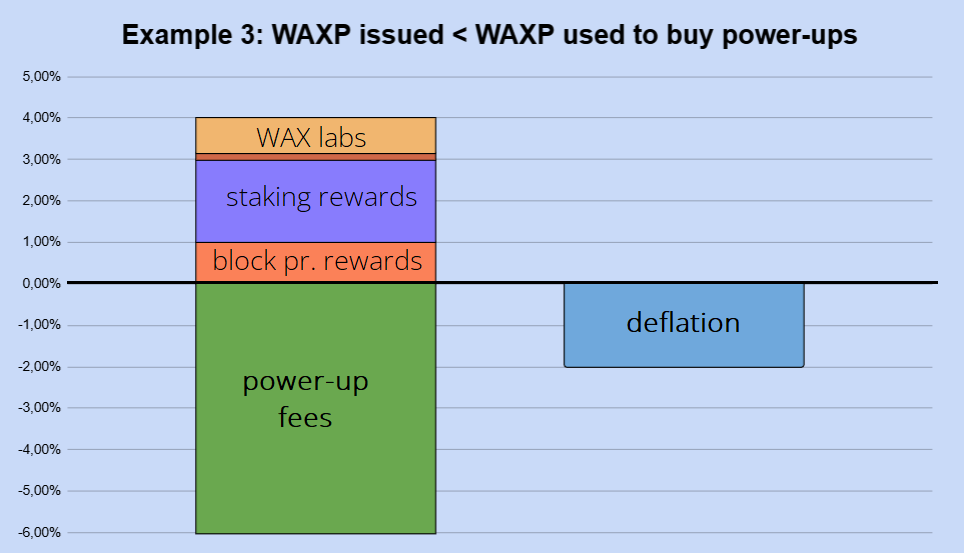

This image summarizes the process:

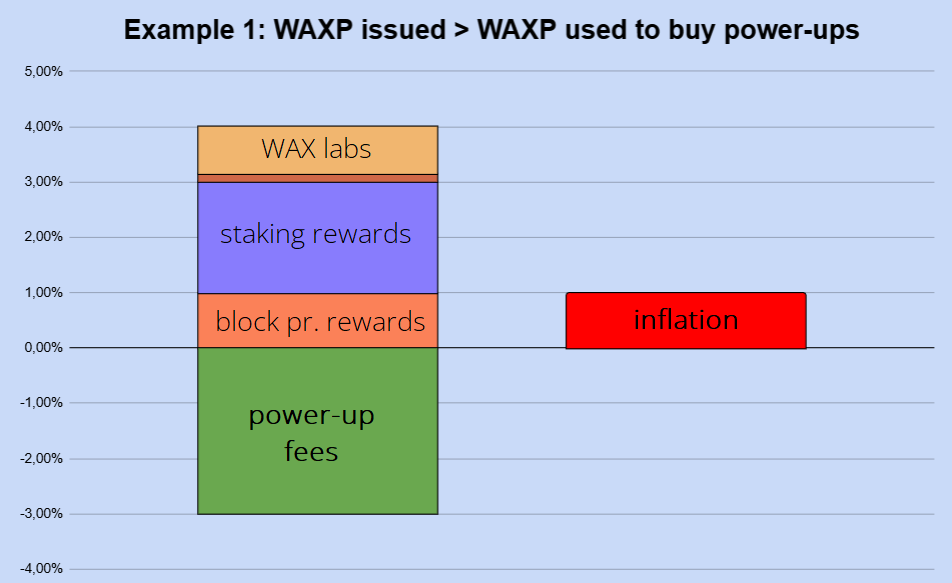

Let’s see three different examples…

EXAMPLE 1: the power-up during the year collects fees equal to 3% of the circulating WAXP. Since the rewards to be distributed are equal to 4% of all the circulating WAXP (this is the fixed quantity that we saw before how it is distributed), 1% is missing: this is the quantity of WAXP that will be created “from scratch”. During this year, therefore, the total supply / circulating supply of WAXP has increased by 1% (this is inflation!)

EXAMPLE 2: the power-up during the year collects 4% of the circulating WAXP. Since the rewards to be distributed are exactly 4%, all the WAXP collected from the fees will be redistributed to stakers, block producers and WAX labs. No new WAXP will be created! During this year, therefore, the total supply / circulating supply has not changed

EXAMPLE 3: The power-up during the year collects 6% of the circulating WAXP. Since the rewards to be distributed are equal to 4%, the WAXP collected from the fees is more than what will be redistributed to stakers, block producers and WAXlabs! The excess amount (i.e. 2%) will be burned forever. During this year, therefore, the total supply / circulating supply of WAXP has actually decreased by 2% compared to the previous year, i.e. there has been a deflation of 2%!

Part four: the Stake to PowerUp ratio

Where WAX started and where it’s going

When the WAX blockchain was born there was no PowerUp, and the only method to carry out transactions was to stake WAXP. The CPU is not an unlimited resource, as Block Producers cannot validate infinite transactions in a block: the amount of CPU that was obtained by a single user depended both on how much WAXP he had staked and on how much WAXP had been staked by other users in total. However, the entire CPU was given to the stakers.

The PowerUp did not replace the stake as a method for carrying out transactions, but as we have seen it has been added to it. A problem therefore arises: how much of the CPU to dedicate to stakers and how much to those who use the PowerUp? This proportion, the ”Stake to PowerUp ratio”, is not fixed, but has been changed over time and is still in the process of changing. Let me quote directly from the last article written by the WAX team on Medium:

WAX has always been about accessibility and performance. Now, we’re flipping our resource model to future-proof the chain.

Where we started:

- 90% of chain resources accessed via staking

- 10% accessed via PowerUp

Where we’re headed:

- 90% via PowerUp

- Only 10% through staking

Right now, we’re around 70/30 PowerUp to staking — but we’re not stopping until we hit the 90/10 target.

The objective is therefore to make the majority of transactions take place with the PowerUp model (90%) while leaving those carried out thanks to staking as a minority part. This will mean that it will still be possible to make free transactions, but the stakers will “only” share 10% of the total CPU, not 100% as happened when the blockchain was born. To carry out the same transaction (and therefore receive the same quantity of CPU) it will be necessary to progressively stake more WAXP, until the model reaches its final percentage (90% of the CPU dedicated to PowerUp and 10% to staking)

Some quick answers to questions you may have…

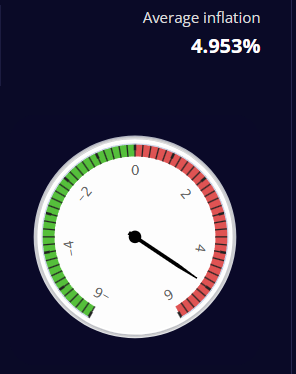

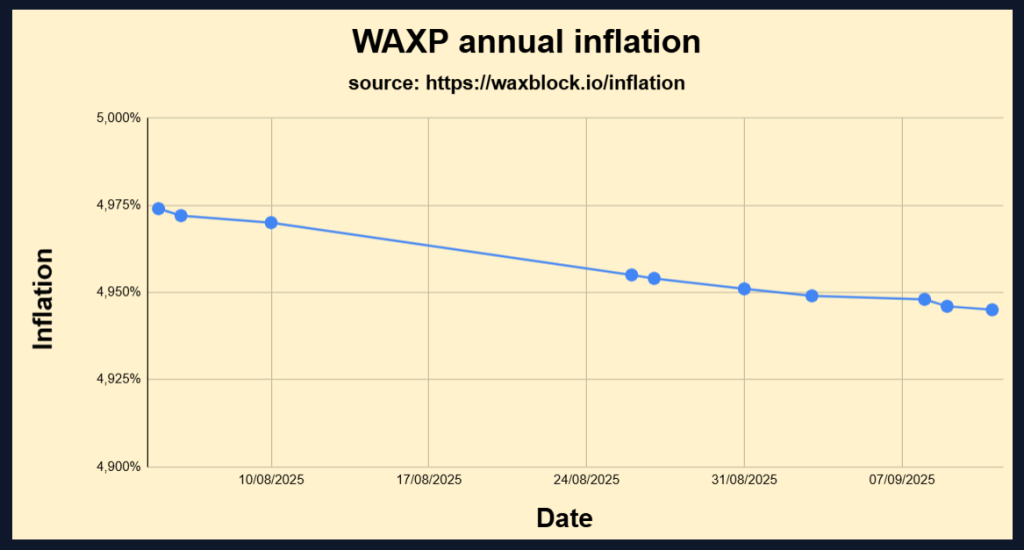

Q: Where can I find out the current state of inflation?

A: Go to https://waxblock.io/inflation

Q: How is it possible that inflation is above 4%?

A: Until September 2025, inflation contains a further 1% (given to block producers, so actually they receive a total of 2%). It will disappear from October 2025 – almost there!

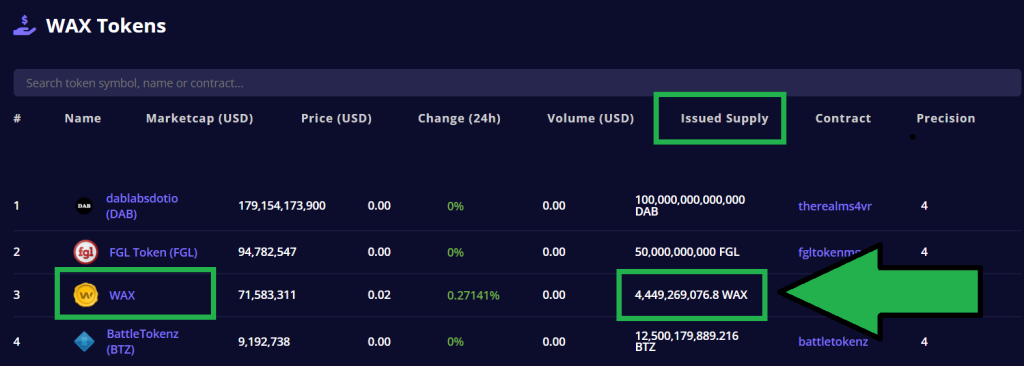

Q: where can I see WAXP’s current circulating supply?

A: Go to https://waxblock.io/tokens and search for this value:

Bonus: inflation in the last month!

If you have any doubts or observations, let me know in the comments below!

See you in the next guide

di0nix

SOURCES

- WAX Medium article Jun 5, 2025

- WAX Medium article Nov 27, 2023 (updated 02/06/2024)

- WAX GitHub tokenomics page

Leave a Reply